Stay Informed with the Anthony Law Blog

PPP Loan Forgiveness Application Updates: Highlights

The SBA recently released its new version of the forgiveness application following some recent legislative changes to the terms of the program. Below are the highlights. Refer to our step-by-step forgiveness application instructions for more details on completing your application.

"The New Normal" Questions About ReOpening During Covid-19

Businesses are opening back up after nearly 3 months of sheltering in place. We are obviously so pleased to be able to move forward, but for all businesses, there are a lot of questions about how to open safely and compliantly.

PPP Loan Forgiveness Application Step-by-Step Guide

We know how important it is to get timely information on the PPP program, so we created this step-by-step guide to help you through the PPP Loan Forgiveness Application.

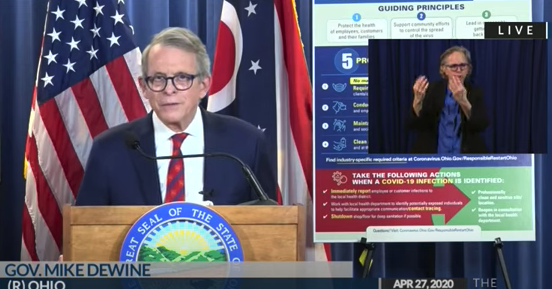

April 27, 2020: DeWine Press Conference: First Phase to Reopen Ohio Announced; Employees and Customers to Wear Face Masks

Recap of the press conference given April 27 by Governor Mike DeWine, Director of the Ohio Department of Health, Dr. Amy Acton, and Lt. Governor Jon Husted:

DeWine asks everyone to keep in mind:

You’ve done an amazing job staying at home.

Coronavirus is still here. It’s just as dangerous as it’s ever been. It’s still living amongst us.

The tools that we’ve used to slow it down are still the same: distance, distance, distance; washing hands; sanitation of surfaces; masks. We’re going to have to continue to use these things.

PPP Question Answered: How Does it Work With Payroll Protection Program if I Re-Hire Laid-Off Employees?

My business was approved for a PPP loan, and we'll be putting employees back onto payroll that had been laid off. How will this work with the changes to unemployment from the CARES Act? Will employees still be eligible for unemployment if we have to lay them off again after the 8-week loan period? Will they still be able to get the extra $600 per week?

PPP Question Answered: Do New Employee Wages Qualify for Payroll Protection Program Forgiveness?

Employment attorney, Chisa Chervenick, answers several questions about the Payroll Protection Program (PPP) and loan forgiveness.

Q: I just hired a new employee. Are their wages considered eligible payroll expenses under the PPP loan? Is forgiveness limited to the wages of former employees only?

A new hire’s wages fall under the definition of payroll costs eligible for forgiveness. Had Congress intended to exclude these wages, it likely would have done so expressly alongside exclusions for wages paid to employees principally residing outside of the U.S. However, there are still outstanding questions about the forgiveness process as we await more guidance from the SBA. We provided some initial guidance about forgiveness here, but there will be more coming.

A Preview of Payroll Protection Program (PPP) Forgiveness

We have now gone through the initial first phase of the Payroll Protection Program (PPP) with businesses submitting their loan applications to their banks. While the initial application process was a bit frenzied, the next phase – loan forgiveness – will be even more important and potentially just as confusing as the application process.

As of the writing of this post, we are still waiting for solid guidelines on how forgiveness will work. However, it is important to begin planning now. Therefore, we are offering this preview of PPP and highlighting both what we know and what we don’t know. We will be providing more guidance as soon as more guidelines are released.

Purpose of the PPP Loan and Certifications Made on the Application

The loan should be used to maintain payroll for existing employees and to bring employees already laid off back onto payroll. This is the entire purpose of the loan: so employers can keep paying people to sit at home and remove some of the burden from the state unemployment system. The states can't deficit spend like the federal government can, so this will allow the federal government to remove some of that financial burden from the states and provide a vehicle for federal funds to help shoulder the load.

Watch Mike and Chisa's Facebook Live Event Discussion on Emergency Paid Sick Leave & Emergency Family Medical Leave

Business attorney Mike Anthony and employment attorney Chisa Chervenick went live on Facebook on Friday, April 17, to discuss emergency paid sick leave and family medical leave as it is affected by and relates to the COVID-19 epidemic.

The following topics, and more, are covered:

Emergency Family Medical Leave (“EFMLE”) including eligibility, reason for leave, pay duration, and cap per workday and aggregate for each employee

Emergency Paid Sick Leave (“EPSL”) for both “Me” and for “Other” including approved reasons for leave, pay during leave, and pay caps.

Question Answered: What Do I Do if My Boss Wants Me Back at Work But I Have No Childcare?

We recently received the following question and know that it is a common issue facing folks during this pandemic. Our employment attorney, Chisa Chervenick, answers it below.

My Boss obtained PPP and wants me back to work to do training activities and organizing. I have children and there is no childcare for them at this time. I’m collecting unemployment. What do I do?

Fed Announces New Main Street Loan Program Funding for Businesses

Also announced are new opportunities for funding the “Main Street Lending Program,” which provides financing to lenders to make direct loans to “main street” businesses. This program will support small and mid-sized businesses that were in good financial standing before the pandemic but that may be too small to access the Federal Reserve’s facilities supporting larger corporates, or that may not qualify for the PPP – although you can potentially participate in both the Main Street program and PPP.